Which of the following examines the costs and expected benefits of a choice?

a. choice-benefit analysis

b. cost-profit analysis

c. cost-benefit analysis

d. choice-profit analysis

Ans: c. cost-benefit analysis

You might also like to view...

If the MPC is 0.8, then the MPS is

A) 0.2. B) 1. C) 5. D) 8.

Which of the following is an example of in-kind transfer?

a. Social security benefits b. Food stamps c. Disability pensions d. Unemployment compensations e. Earned income tax credit

If the income multiplier is 2 and the equilibrium national income level is $8,000 billion, then a $500 billion decrease in aggregate expenditure will cause

a. the aggregate expenditure curve to shift to the right and national income to increase by $1,000 billion b. the aggregate expenditure curve to shift to the left and national income to decrease by $1,000 billion c. the aggregate expenditure curve to shift to the right and national income to increase by $2,000 billion d. the aggregate expenditure curve to remain unchanged but an upward movement along the curve that shows a $2,000 increase in national income e. the aggregate expenditure curve to remain unchanged but an upward movement along the curve that shows a $2,000 decrease in national income

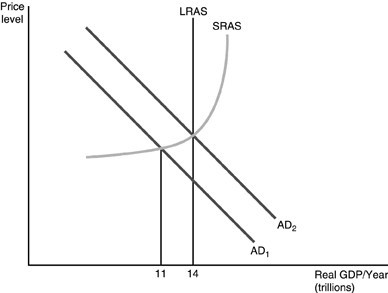

Refer to the above figure. The government has just engaged in expansionary fiscal policy shifting the aggregate demand curve from AD1 to AD2. Interest rates have started to rise. Which of the following statements is TRUE in the short run?

Refer to the above figure. The government has just engaged in expansionary fiscal policy shifting the aggregate demand curve from AD1 to AD2. Interest rates have started to rise. Which of the following statements is TRUE in the short run?

A. Real GDP will fall back to $11 trillion since the effect that increased government spending has on real GDP is short lived. B. Real GDP will end up somewhere between $11 and $14 trillion as businesses and consumers reduce their spending in response to the increase in interest rates. C. Real GDP will go beyond $14 trillion as businesses and consumers react to the increase in interest rates. D. Real GDP will be $14 trillion since the effect of government spending is not influenced by interest rates.