Paula is considering going to law school. If she does, she will spend $60,000 on tuition and books to get a college education (during the first time period), $120,000 on tuition and books to get a law degree (during the second time period), and her law degree will earn her $620,000 during the remainder of her work-life (during the third time period). Paula's time preference for money is associated with a per-period interest rate of 20 percent. Approximately what is Paula's present value of obtaining a law degree?

A. $621,900

B. $100,100

C. $270,500

D. $440,000

E. $210,400

Answer: C

You might also like to view...

The capital and financial account balance is equal to

A) the value of exports of U.S. capital goods minus the value of imports of capital goods into the United States. B) exports minus imports. C) foreign assets owned by the United States minus U.S. assets owned by foreigners. D) U.S. investment abroad minus foreign investment in the United States. E) foreign investment in the United States minus U.S. investment abroad.

Which of the following is most likely to lead to a decrease of 10% in the nominal demand for money?

A) An increase in real income of 5% B) A decrease in real income of 5% C) A decline of 10% in the price level D) An increase of 10% in the price level

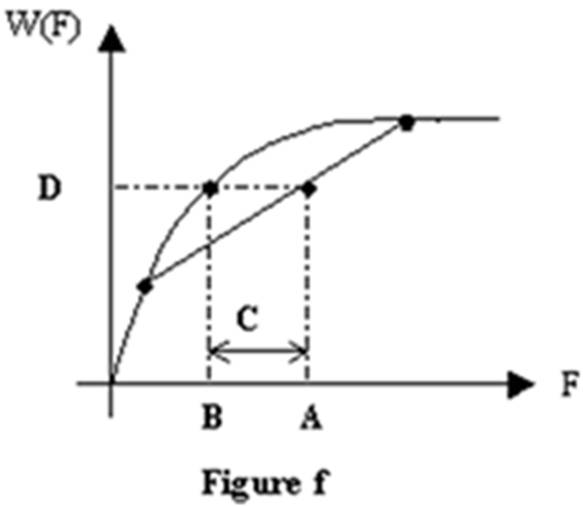

Refer to Figure f. A benefit function is plotted in Figure f. The distance C represents the:

A. risk premium of the consumption bundle.

B. expected utility of the consumption bundle.

C. certainty equivalent of the consumption bundle.

D. expected consumption.

According to the principle of comparative advantage, a nation should specialize in economic activities

A. for which it has an absolute advantage. B. for which it has no absolute advantage. C. that incur lower opportunity costs. D. that incur higher opportunity costs.