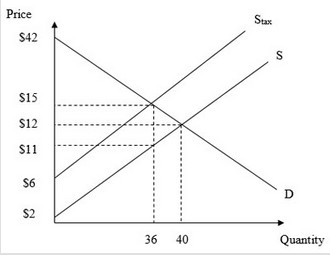

Use the figure below to answer the following question. By how much does total Economic Surplus decrease after the tax is imposed?

By how much does total Economic Surplus decrease after the tax is imposed?

A. $32

B. $4

C. $38

D. $2

Answer: C

You might also like to view...

Based on the figure below. Starting from long-run equilibrium at point C, a tax cut that increases aggregate demand from AD to AD1 will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. B; C C. B; A D. D; B

A market-determined price

A. is determined by the manager of a firm. B. is an endogenous variable C. is determined by the intersection of demand and supply curves. D. both a and b E. both b and c

Which of the following is included in personal income but not in national income?

A. Compensation for workers. B. Proprietors' income. C. Corporate profits. D. Social Security payments.

The period in which at least one input is fixed in quantity is the

A. Production run. B. Long run. C. Short run. D. Investment decision.