When those most likely to produce the outcome insured against are the ones who purchase insurance, insurance companies are said to face the problem of

A) fraudulent claims.

B) moral hazard.

C) adverse selection.

D) pecuniary purchases.

C

You might also like to view...

Citicorp charges an 11 percent interest rate on all new car loans. If the inflation rate is 6 percent, Citicorp receives a real interest rate of

A) 11 percent. B) 6 percent. C) 1.83 percent. D) 0.54 percent. E) 5 percent.

If a firm shuts down in the short run, then

a. total revenue and total cost drop to zero b. total revenue drops to zero, but the firm must still pay its fixed cost c. total revenue drops to zero, but the firm must still pay some variable cost d. total cost drops to zero, but the firm still earns some residual revenues e. neither total revenue nor total cost drops to zero

Consider an economy where Y = $3,500 . C = $500 + (0.80Y), and where autonomous investment is equal to $200. a . Is this economy in equilibrium? Explain. b. What will happen if people try to increase their saving to $400

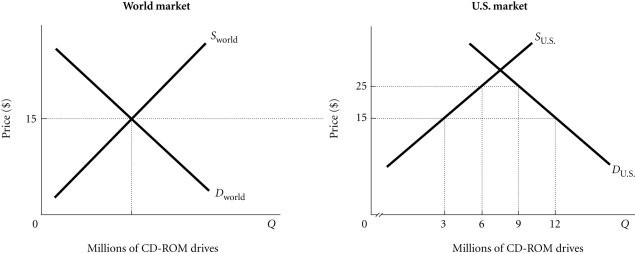

Refer to the information provided in Figure 4.5 below to answer the question(s) that follow. Figure 4.5Refer to Figure 4.5. Assume that initially there is free trade. If the United States then imposes a $10.00 tariff per CD-Rom drive on imported CD-Rom drives,

Figure 4.5Refer to Figure 4.5. Assume that initially there is free trade. If the United States then imposes a $10.00 tariff per CD-Rom drive on imported CD-Rom drives,

A. the quantity of CD-Rom drives supplied by U.S. firms will increase by 3 million. B. U.S. imports of CD-Rom drives will increase by 3 million. C. the quantity of CD-Rom drives demanded will be reduced by 6 million. D. the price of CD-Rom drives in the United States will decrease to $5.