According to the Taylor rule, if the target rate of inflation for the Fed is two percent and real GDP rises by one percent above potential GDP, then the Fed should:

A. Raise the real federal funds rate by one percentage point

B. Lower the real federal funds rate by one percentage point

C. Raise the real federal funds rate by half of a percentage point

D. Lower the real federal funds rate by half of a percentage point

C. Raise the real federal funds rate by half of a percentage point

You might also like to view...

Based on the Saving-Investment Diagram, if the world real interest rate is indicated by C, then ________

A) the difference between values H and D measures the net capital outflow B) the difference between values H and D measures the trade deficit C) the domestic real interest rate is indicated by B D) the difference between values H and F measures the trade deficit E) none of the above

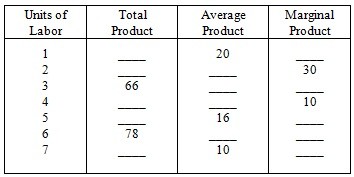

Fill out the table and answer the question below.  Marginal product is negative when ________ units of labor are employed.

Marginal product is negative when ________ units of labor are employed.

A. 5 units of labor are employed. B. 7 units of labor are employed. C. 6 units of labor are employed. D. both b and c.

Demand and marginal revenue curves are downward sloping for monopolistically competitive firms because:

A. product differentiation allows each firm some degree of monopoly power. B. there is free entry and exit. C. there are a few large firms in the industry and each acts as a monopolist. D. mutual interdependence among all firms in the industry leads to collusion.

The most recent financial crisis started in

A) stock market. B) bond market. C) foreign exchange market. D) housing market.