It does not matter whether a tax is levied on the buyers or the sellers of a good because

a. sellers always bear the full burden of the tax.

b. buyers always bear the full burden of the tax.

c. buyers and sellers will share the burden of the tax.

d. None of the above is correct; the incidence of the tax does depend on whether the buyers or the sellers are required to pay the tax.

c

You might also like to view...

The basic truth that underlies the study of economics is the fact that we all face

A. risk. B. scarcity. C. death. D. taxes.

When a company from Germany builds an automobile factory in the United States, the German firm has engaged in foreign direct investment

a. True b. False Indicate whether the statement is true or false

Macroeconomics:

A. is concerned with the expansion of a small business into a large corporation. B. is narrower in scope than microeconomics. C. analyzes mergers and acquisitions between firms. D. is concerned with the expansion and contraction of the overall economy.

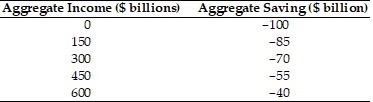

Refer to the information provided in Table 23.2 below to answer the question(s) that follow.

Table 23.2 Refer to Table 23.2. Society's MPS is

Refer to Table 23.2. Society's MPS is

A. 0.1. B. 0.2. C. 0.3. D. 0.9.