An investor has $450,000 to invest in two types of investments. Type A pays 6% annually and type B pays 7% annually. To have a well-balanced portfolio, the investor imposes the following conditions. At least one-third of the total portfolio is to be allocated to type A investments and at least one-third of the portfolio is to be allocated to type B investments. What is the optimal amount that should be invested in each investment?

A. $160,000 in type A (6%), $290,000 in type B (7%)

B. $0 in type A (6%), $450,000 in type B (7%)

C. $450,000 in type A (6%), $0 in type B (7%)

D. $300,000 in type A (6%), $150,000 in type B (7%)

E. $150,000 in type A (6%), $300,000 in type B (7%)

Answer: E

Mathematics

You might also like to view...

Find the effective rate of interest.5% compounded continuously

A. 5.451% B. 5.374% C. 5.127% D. 5.089%

Mathematics

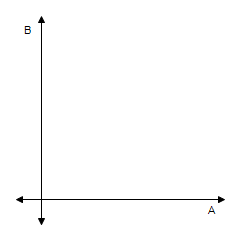

Solve the system by the substitution method.

A. {(0, 1), (-1, 0)} B. {(0, -1), (-1, 0)} C. {(0, -1), (1, 0)} D. {(0, 1), (1, 0)}

Mathematics

Find the greatest common factor of the terms.64a8b4, 56a6b8

A. 448a8b8 B. 4a2b4 C. 8a8b8 D. 8a6b4

Mathematics

Complete.814 mm2 = _______ m2

A. 0.0814 B. 0.00814 C. 0.000814 D. 0.814

Mathematics