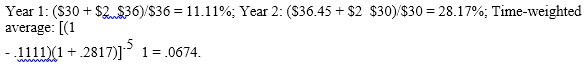

Suppose you purchase one share of the stock of Volatile Engineering Corporation at the beginning of year 1 for $36. At the end of year 1, you receive a $2 dividend and buy one more share for $30. At the end of year 2, you receive total dividends of $4 (i.e., $2 for each share) and sell the shares for $36.45 each. The time-weighted return on your investment is

A. -1.75%.

B. 4.08%.

C. 6.74%.

D. 11.46%.

E. 12.35%.

C. 6.74%.

You might also like to view...

The first step in finding a foreign market for a product is to determine whether a market exists for a firm's products.

Answer the following statement true (T) or false (F)

Describe three collaboration tools that can be used for virtual meeting facilitation when distance or other factors prevent face-to-face gatherings

Distinguishing between product and period costs is sometimes guided by the value-added principle.

Answer the following statement true (T) or false (F)

Flashbinder Guitars, Inc is considering a lockbox system that will increase its check processing cost

by $.15 per check. The company estimates an average check size of $1,700 and expects the lockbox to reduce check collection time by 3 days. What annual before-tax yield must Flashbinder Guitars, Inc earn on its marketable securities for the lockbox system to be beneficial? A) 0.735% B) 1.118% C) 1.825% D) 1.074%