A company has three employees. Total salaries for the month of January were $8,000. The federal income tax rate for all employees is 15%. The FICA-social security tax rate is 6.2% and the FICA-Medicare tax rate is 1.45%. Calculate the amount of employee taxes withheld and prepare the company's journal entry to record the January payroll assuming these were the only deductions.

What will be an ideal response?

| Salaries Expense | 8,000 | ? |

| FICA-Social Security Taxes Payable ($8,000 × .062) | ? | 496 |

| FICA-Medicare Taxes Payable ($8,000 × .0145) | ? | 116 |

| Employees' Federal Income Taxes Payable ($8,000 × .15) | ? | 1,200 |

| Salaries Payable | ? | 6,188 |

You might also like to view...

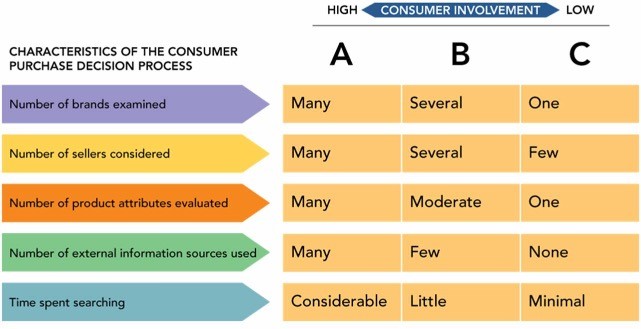

Figure 4-3In Figure 4-3 above, column B represents which of the following in terms of consumer involvement and product knowledge?

Figure 4-3In Figure 4-3 above, column B represents which of the following in terms of consumer involvement and product knowledge?

A. consideration set B. integrated problem solving C. extended problem solving D. routine problem solving E. limited problem solving

By definition, a(n) ________ proposal is one your audience has asked you to submit

A) external B) internal C) solicited D) unsolicited E) noncompetitive

When might a latitude of noncommitment occur?

a. when the new argument is still too close to the reject category b. when the new information does not cause the person to accept or reject a position c. when your own belief is too far from credibility d. when your own belief infringes upon a person’s right to analyze

Regulation Z is an administrative agency regulation that sets forth detailed rules for compliance with the ________ Act

A) Fair Credit Reporting B) Truth-in-Lending C) Fair Credit Billing D) Fair Debt Collection Practices