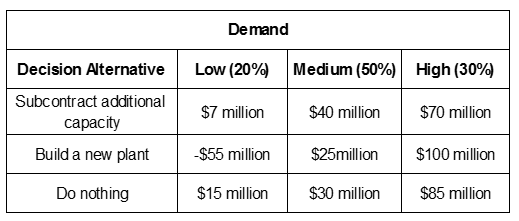

XYZ is a paint product manufacturer, and one of the plants is experiencing a substantial increase in demand. The future demand for the products could be low, medium, or high, with probabilities estimated to be 25%, 50%, and 30%, respectively. The company wants to determine the financial impact associated with the three decision alternatives under the varying levels of demand. Given the following payoff matrix, compute the expected regret for the option of subcontracting additional capacity.

A. $10.6 million

B. $21.5 million

C. $9.5 million

D. $14 million

A. $10.6 million

You might also like to view...

What kinds of tactics may be used by an employer in a union organizing campaign. In your response, identify which tactics are legal and illegal?

What will be an ideal response?

A "short-form merger" requires shareholder approval of both corporations

a. True b. False Indicate whether the statement is true or false

Murphy Construction Materials Company has a sales office that sells concrete culvert pipes to property developers

The sales office is a revenue center and prepares a monthly responsibility report. The partially completed responsibility report is provided. Revenue Center Responsibility Report Product Type Actual Sales Revenue Flexible Budget Variance U/F Flexible Budget Sales Volume Variance U/F Static Budget 40 inch $31,700 $30,750 $40,800 36 inch long 40,150 42,200 33,000 36 inch short 36,200 33,100 31,000 32 inch 19,100 20,000 28,400 The company uses management by exception to address flexible budget variances. On which product type would the company first focus? A) 40 inch B) 36 inch long C) 36 inch short D) 32 inch

In the context of global trade, which of the following statements is true of balance of payments?

A. It includes foreign borrowing and lending. B. Its surplus indicates more money flowing out than in. C. It excludes overseas investments. D. Its deficit indicates more money flowing in than out.