The price elasticity of demand is -1.5. The price elasticity of supply is 1.5. The fraction of a specific tax that is borne by producers is ________

A) 0

B) 0.25

C) 0.5

D) 0.75

E) 1

C

Economics

You might also like to view...

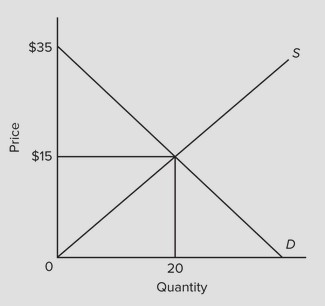

Use the figure below to answer the following question. At equilibrium, producer surplus is

At equilibrium, producer surplus is

A. 300. B. 150. C. 200. D. 400.

Economics

Differentiate between the four market structures on the basis of the type of products sold

What will be an ideal response?

Economics

The "incidence of a tax" is the term used to indicate

a. the responsibility for collecting the tax. b. who actually bears the tax burden. c. who the tax is initially levied on. d. the regressive rate structure of the tax.

Economics

A decrease in the interest rate due to an increase in the supply of loanable funds is referred to as the __________ effect

A) expectations B) liquidity C) income D) a and c E) a, b and c

Economics