Consider a fixed-payment security that pays $250 at the end of every year for eight years. If the annual rate of discount is 3 percent, calculate the present value of the bond.

What will be an ideal response?

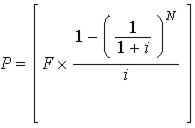

Use the equation

With F = $250, i = 0.03, and N = 8, then P = $1,754.92.

You might also like to view...

An experiment was conducted to test the effects of coupon value on redemption. Personal interviews were conducted in New York with 280 shoppers who were entering a supermarket

These shoppers were given a coupon for one of four brands prior to entering the store. Two coupon values were used, one offering 15-cents off and the other 50-cents off. Shoppers were randomly assigned to these two coupon-value levels. Four brands—Tide detergent, Kellogg's corn flakes, Aim toothpaste, and Joy liquid dishwashing detergent were used. These same shoppers were re-interviewed upon leaving the store and asked to report on any coupons used in the store. What extraneous variable most likely will influence the results of this experiment? A) maturation B) mortality C) statistical regression D) history E) testing effects

A parent company is a company that ________.

A) is controlled by another corporation B) owns a controlling interest in another company C) is the first to begin operations in an industry D) has any level of investment in another company

The expectations that organizational members share about how to think and act is known as ______.

a. the culture gap b. competitive advantage c. organizational culture d. economic disadvantage

Which of the following statements accurately brings out the difference between tangible and intangible resources?

A. Tangible resources take a longer time to build, whereas intangible assets can be built comparatively easily. B. Tangible assets are difficult for competitors to imitate, whereas intangible assets can be easily replicated. C. Tangible resources contribute to a company's competitive advantage, whereas intangible resources have little effect on competitive advantage. D. Tangible assets can be bought on the open market by anyone with the necessary cash, whereas intangible assets cannot be easily purchased.