If a person is taxed $100 on an income of $1,000, taxed $180 on an income of $2,000, and taxed $220 on an income of $3,000, this person is paying a:

A. progressive tax.

B. poll tax.

C. proportional tax.

D. regressive tax.

Answer: D

You might also like to view...

When a Clarke tax is used to finance a public good, each person's tax equals

a. the amount that he is willing to pay for the good. b. the difference between the value he places on the public good and its cost. c. the cost of the public good minus the value that other people claim to receive from it. d. everyone else's tax, with the sum equaling the cost of producing the public good.

The international oil price hike by OPEC was an adverse supply shock faced by the United States in the 1970s.

a. true b. false

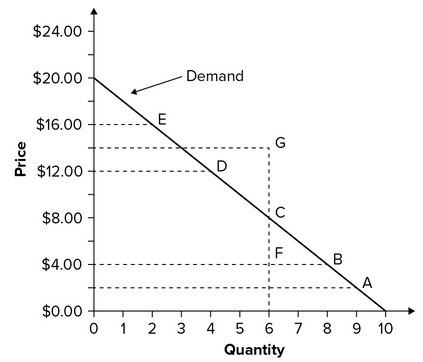

Refer to the graph showing the demand for books. The quantity demanded when price is $16.00 is:

A. 4 books. B. 8 books. C. 2 books. D. 6 books.

In the classical model, real Gross Domestic Product (GDP) per year is

A. due to supply conditions plus the extent of government intervention in the economy. B. demand determined. C. supply determined. D. determined by supply and demand conditions together.