Supply-side economics stresses that

a. budget deficits will stimulate demand, output, and employment.

b. budget deficits will lead to higher interest rates, which will weaken their expansionary impact.

c. an increase in government expenditures financed by higher tax rates will cause real income to rise.

d. changes in marginal tax rates exert important effects on real output and employment.

D

You might also like to view...

The amount of a tax paid by the buyers will be larger the

A) more elastic the demand and the more inelastic the supply. B) more inelastic the demand and the more elastic the supply. C) more inelastic are both the supply and demand. D) more elastic are both the supply and demand.

Which does an intention-to-treat parameter measure in a program evaluation study?

A. The effect of participation in the program. B. The effect of the program on those who were eligible but did not participate. C. The effect of being eligible to participate in the program. D. The effect on the probability of participation due to being eligible to participate.

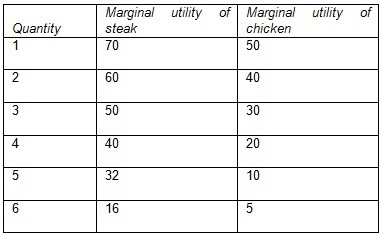

Assume James purchases only two goods, steak and chicken, with his weekly income of $60. The price of steak is $10 and the price of chicken is $5. The following table shows the marginal utility James gets from each additional pound of steak and chicken:  Given the above information, what quantities of steak and chicken should James purchase to maximize his utility?

Given the above information, what quantities of steak and chicken should James purchase to maximize his utility?

A. 4 steak, 4 chicken B. 2 steak, 5 chicken C. 3 steak, 2 chicken D. 5 steak, 2 chicken E. none of the above

A major problem with using the egalitarian principle to distribute income is that

A) it would eliminate the incentives that rewards provide in an economic system. B) it is difficult to know when an equal distribution of income has been achieved. C) it would not be fair to the wealthy. D) there exist no mechanisms to carry out such a scheme.