Answer the following statement true (T) or false (F)

1) The major expenditure of local governments is for education.

2) A tax is progressive if the average tax rate rises as income increases.

3) If you pay a $2,000 tax on $10,000 of taxable income and a $4,000 tax on a taxable income of

$16,000, the tax is progressive.

4) The marginal tax rate is the tax rate that applies to additional income.

1) T

2) T

3) T

4) T

You might also like to view...

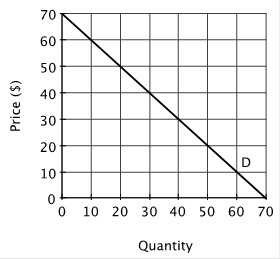

Refer to the figure below.  This firm's marginal revenue curve would intersect the vertical axis at ________.

This firm's marginal revenue curve would intersect the vertical axis at ________.

A. $70 B. $35 C. $20 D. $0

The above figure shows the market for oil. Because of the development of a new deep sea drilling technology the

A) demand curve shifts from D1 to D2 and the supply curve does not shift. B) demand curve shifts from D1 to D2 and the supply curve shifts from S1 to S2. C) demand curve does not shift, and the supply curve shifts from S2 to S1. D) demand curve does not shift, and the supply curve shifts from S1 to S2.

To be binding, a price floor must be set above the equilibrium price

a. True b. False Indicate whether the statement is true or false

Pure private goods are nonrival in consumption.

A. True B. False C. Uncertain