Sellers of a product will bear the larger part of the tax burden, and buyers will bear a smaller part of the tax burden, when the

a. tax is placed on the sellers of the product.

b. tax is placed on the buyers of the product.

c. supply of the product is more elastic than the demand for the product.

d. demand for the product is more elastic than the supply of the product.

d

You might also like to view...

Suppose many new brands start selling coffee in an economy, increasing the options that consumers have for coffee. This will result in: a. a decrease in the elasticity of demand for every brand of coffee. b. an increase in the elasticity of demand for every brand of coffee. c. zero elasticity of demand for every brand of coffee

d. an infinite elasticity of demand for every brand of coffee.

If a major union goes on strike, then the country would be operating inside its production possibilities frontier

a. True b. False Indicate whether the statement is true or false

If the natural rate of unemployment is 5.2 percent and the actual rate of unemployment is 5.7 percent, then by definition there is

a. cyclical unemployment amounting to 0.5 percent of the labor force. b. frictional unemployment amounting to 0.5 percent of the labor force. c. structural unemployment amounting to 0.5 percent of the labor force. d. search unemployment amounting to 0.5 percent of the labor force.

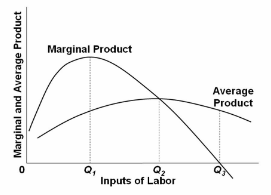

Refer to the diagram, where variable inputs of labor are being added to a constant amount of property resources. Marginal cost will be at a minimum for this firm when it is hiring:

A. Q 3 workers.

B. Q 2 workers.

C. Q 1 workers.

D. more than Q 3 workers.