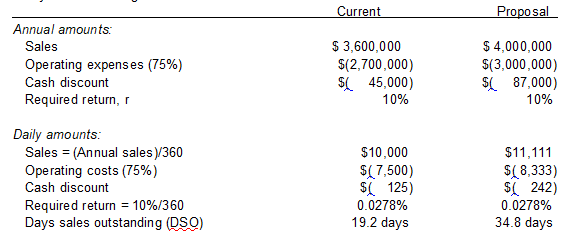

Ray Smith also wants you to examine his company’s credit policy to determine if changes are needed because one of his employees, who graduated recently with a finance major, has recommended that the credit terms be changed from 2/10, net 30 to 3/20, net 45 and that both the credit standards and the collection policy be relaxed. According to the employee, such a change would cause sales to increase from $3.6 million to $4.0 million. Currently, 62.5% of SSP’s customers pay on Day 10 of the billing cycle and take the discount, 32% pay on Day 30, and 5.5% pay (on average) on Day 60. If the new credit policy is adopted, Smith estimated that 72.5% of customers would take the discount, 10% would pay on Day 45, and 17.5% would pay late, on Day 90. Bad debt losses for both policies are

expected to be trivial. Variable operating costs are currently 75% of sales, the cost of funds used to carry receivables is 10%, and its marginal tax rate is 40%. None of these factors would change as a result of a credit policy change. To help decide whether to adopt the new policy, Smith has asked you to answer the following questions:

a. What variables make up a firm’s credit policy? In what direction would each be changed if the credit policy is relaxed? How would each variable tend to affect sales, the level of receivables, and bad debt losses?

b. How are the days sales outstanding (DSO) and the average collection period (ACP) related to one another? What would the DSO be if the current credit policy is maintained? If the proposed policy is adopted?

c. What is the dollar amount of discounts granted under the current and the proposed credit policies?

d. Should SSP make the change? Assume that operating and credit costs are paid on the day of the sale.

e. Suppose the company makes the proposed change, but its competitors react by making changes in their own credit terms, with the net result being that gross sales remain at the $3.6 million level. What would be the effect on the company’s value?

f. (1) What does the term monitoring accounts receivable mean?

(2) Why would a firm want to monitor its receivables?

(3) How might the DSO and the aging schedule be used in this process?

a. The variables that make up a firm’s credit policy are (1) credit standards, (2) credit terms, (3) collection policy, and (4) monitoring function.

To qualify for credit in the first place, customers must meet the firm’s credit standards. These dictate the minimum acceptable financial position required of customers to receive credit. Also, a firm might impose differing credit limits depending on the customer’s financial strength. Tight credit standards would tend to lower sales (fewer customers would qualify for credit), decrease the level of receivables held, and would cause a decrease in the amount of bad debt expenses. The level of receivables held would be decreased due to the lower level of sales and also the probability that customers now qualifying for credit would take less time to pay. Bad debt expenses should decrease due to raising customers' minimum acceptable financial positions.

Credit terms refer to the conditions of the credit sale, including the length of time until payment is due, whether a cash discount is available for early payment, and so on. If a firm offers a cash discount for early payment, all else equal, the average balance of accounts receivable will decrease if some customer take the cash discount—without the cash discount, these customers would wait until the due date to make payment. If a firm increases the cash discount it offers, generally sales will increase because the customers of competitors will be attracted to the new credit terms.

Collection policy refers to the procedures that the firm follows to collect past?due accounts. These can range from a simple letter or phone call to turning the account over to a collection agency. A tight collection policy would decrease the level of receivables held, as customers would decrease the length of time they took to pay their bills. A tight collection policy would also cause a decrease in the amount of bad debt losses the firm incurred.

The monitoring function refers to the periodic evaluation of receivables and customers’ payment patterns to ensure the credit policy is being administered correctly, and to determine whether changes in the policy are necessary. If firms do not monitor their accounts receivable, they might find (perhaps too late) that the cash flow pattern associated with collections of credit sales has changed significantly.

A relaxing of credit policy would tend to increase sales, increase the level of receivables held, and increase the amount of bad debt expenses. A tightening of credit policy would have the exact opposite effect

b. ACP and DSO measure the same thing—the average length of time the firm must wait after making a sale before receiving payment. DSO is the more preferred business nomenclature. Under the current credit policy, the DSO is approximately 19 days:

DSO0ld = 0.625(10) + 0.32(30) + 0.055(60) = 19.15 days.

Under the proposed credit policy, the dso would increase to approximately 35 days:

DSOnew = 0.725(20) + 0.10(45) + 0.175(90) = 34.75 days.

c. Of the $3,600,000 in current sales 62.5 percent are affected by the discount. So,

DiscountsOld = 0.02 x $3,600,000 x 0.625 = $45,000

Under the new policy, the expected cost of discounts is:

DiscountsNew = 0.03 x $4,000,000 x 0.725 = $87,000

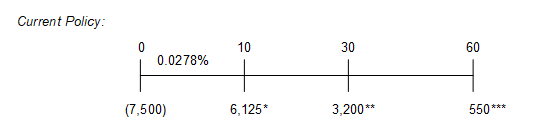

d. Analysis of the change:

*62.5% of the paying customers take the 2% cash discount; thus, the amount paid by these customers on Day 10 = [($3,600,000 x 0.98)(0.625)]/360 = ($10,000 x 0.98)0.625 = $6,125.

**The amount collected on Day 30 is 32% of the credit sales. Because bad debts are negligible, the amount collected on Day 30 = [($3,600,000)(0.32)]/360 = ($10,000)0.32 = $3,200.

*** The amount collected on Day 60 is 5.5% of the credit sales. The amount collected on Day 60 = [($3,600,000)(0.055)]/360 = ($10,000)0.055 = $550.

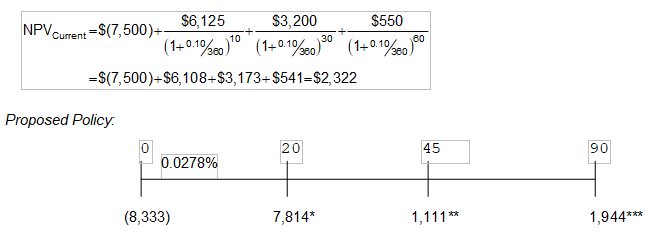

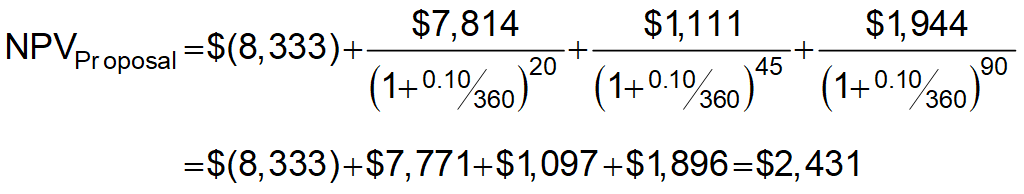

*72.5% of the customers take the 3% cash discount; thus, the amount paid by these customers on Day 10 = [($4,000,000 x 0.97)(0.725)]/360 = $7,814.

**The amount collected on Day 45 is 10% of the credit sales. Because bad debts are negligible, the amount collected on Day 45 = ($4,000,000 x 0.10)/360 = $1,111.

***The amount collected on Day 90 is 17.5% of the credit sales. The amount collected on Day 90 = ($4,000,000 x 0.175)/360 = $1,944.

SSP should change the credit terms because NPV would be increased with the propose terms.

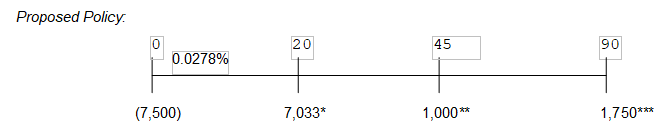

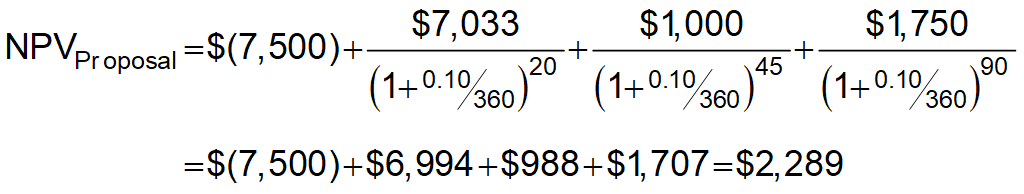

*72.5% of the customers take the 3% cash discount; thus, the amount paid by these customers on Day 10 = [($3,600,000 x 0.97)(0.725)]/360 = $7,033.

**The amount collected on Day 45 is 10% of the credit sales. Because bad debts are negligible, the amount collected on Day 45 = ($3,600,000 x 0.10)/360 = $1,000.

***The amount collected on Day 90 is 17.5% of the credit sales. The amount collected on Day 90 = ($3,600,000 x 0.175)/360 = $1,750.

In this case, SSP should not change the credit terms because NPV would be decreased with the propose terms.

g(1). To monitor a firm’s accounts receivable means to analyze the effectiveness of its credit policy in an aggregate sense.

g(2). A firm would want to monitor its receivables because the optimal credit policy, and hence the optimal level of accounts receivable, depends on the firm’s own unique operating conditions. A firm with excess capacity and low variable production costs should extend credit more liberally, and thus carry a higher level of accounts receivable, than a firm operating at full capacity or having a slim profit margin. Optimal credit policies vary among firms, or even for a single firm over time.

g(3). The DSO and aging schedule can be used to monitor a firm’s accounts receivable. If the firm’s DSO is higher than the industry average it means that the firm might have an excessive investment in receivables (unless of course it is a case of excess capacity and low variable production costs, as discussed earlier). Also, the firm’s DOS should be compared with the firm’s own credit policy. If the firm’s DSO is longer than the maximum credit period, then the firm’s customers, on average, are not paying their bills on time. An aging schedule breaks down accounts receivable according to how long they have been outstanding.

Management should constantly monitor the firm’s DOS and aging schedules to detect trends, to see how the firm’s collection experience compares with its credit terms, and to see how effectively the credit department is operating in comparison with other firms in the industry. If the DSO starts to lengthen, or if the aging schedule begins to show an increasing percentage of past-due accounts, then the firm’s credit policy might have to be tightened.

You might also like to view...

In terms of marketing communications, standardization is:

A) presenting the same message across national boundaries B) a form of adaptation C) new product development D) a new form of the promotions mix

Use the five transactions for Hennigan Company described below to answer the question(s) that follow(s). Dec 1 Hennigan purchases two new saws on credit at $375 each. The saws are added to Hennigan's rental inventory. Payment is due in 30 days. 8 Hennigan accepts advance deposits for tool Company of $75. 15 Hennigan receives a bill from Farmer's Electric Company for $150 . Payment is due in 30

days. 20 Customers are charged $750 by Hennigan for tool Company. Payment is due from the customers in 30 days. 31 Hennigan receives $500 in payments from the customers that were billed for Company on December 20. Refer to the transactions for Hennigan Rentals. Based on the above transactions, how much is still owed to Hennigan on December 31 from its customers? a. $ -0- b. $ 250 c. $ 500 d. $ 750

An example of which nontraditional work schedule allows an employee to choose to work a 7:00 a.m. to 3:00 p.m. shift rather than the more traditional 9:00 a.m. to 5:00 p.m. workday?

A. flextime B. compressed workweek C. job sharing D. telecommuting

A contingent liability should be entered into the accounting records if it is both probable and reasonably estimable

Indicate whether the statement is true or false