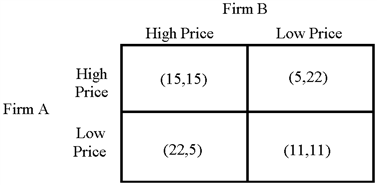

Figure 13-4

?

The above matrix (Figure 13-4) displays the possible profit results of two firms, A and B, from following two different possible strategies: charging a high price and charging a low price. In each cell, the first number is the profit of firm A, and the second number is the profit of firm B.

a. Assume that collusion is not possible. Determine the optimal strategy for each firm. Explain why it is the best strategy to follow.

b. Based on your answer to a., explain why firms collude. What are the pitfalls of collusion?

What will be an ideal response?

a. The optimal strategy for each is to charge a low price. If either charges a high price, the other can do better by charging a low price. (This would put the firms in the upper right or lower left cells.) But the firm which has the high price can improve its profits by switching to a low price. The result is that firms are in the lower right cell, each earning a profit of 11.b. The firms end up with total profit of 22 by charging low prices. If they are able to collude, they can earn total profit of 30. If collusion is possible, they have incentive to do it. One obvious pitfall is cheating—either firm can do better for itself by dropping its price, which leads to a breakdown in the collusion.

You might also like to view...

The unemployment rate generally falls during ________ in the business cycle

A) a peak B) a recession C) a trough D) an expansion

The law of diminishing marginal productivity implies that the marginal product of a variable input:

A. never declines. B. eventually declines. C. always declines. D. is constant.

The regulation that sets the minimum fraction of deposits banks must hold in reserve is called the:

A. reserve requirement. B. interest rate. C. dual mandate. D. money multiplier.

The portion of the budget deficit or surplus that would exist even if the economy were at its potential income is called the cyclical deficit or cyclical surplus.

Answer the following statement true (T) or false (F)