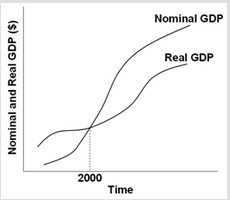

Use the following graph to answer the next question. The year 2000 must be the ________.

The year 2000 must be the ________.

A. year when depreciation or capital consumption equaled zero

B. year when GDP equaled 100

C. base year of the GDP price index

D. year when the GDP price index is zero

Answer: C

You might also like to view...

If the prices for the same goods and services are different in two nations, the exchange rate adjusts over the long run to achieve

A) zero net exports for each nation. B) purchasing power parity between the two currencies. C) balance of payments account between the two nations equal to zero. D) a zero current account balance between the two nations. E) interest rate parity.

Suppose that the capital stock initially is 1000, the depreciation rate is 0.08, and investment is 220. This makes the net growth of the capital stock

A) 300. B) 237.6. C) 202.4. D) 140.

(Consider This) During and immediately following the severe recession of 2007-2009, commercial bank reserves held on deposit in Federal Reserve Banks:

A. rose to a high of 50 percent of total checkable deposits held by banks. B. fell significantly as commercial banks withdrew reserves to pay off heavy debt obligations. C. increased significantly because of Fed purchases of securities from commercial banks and the paying of interest on bank reserves. D. increased significantly because the Fed increased the required reserve ratio.

To ensure that ________ will be accepted, the U.S. government implicitly promises the public that it will not print money so fast that it loses its value.

A. commodity money B. barter cash C. paper money D. exchange rates