An office building owned by Abby and used in her business was destroyed in a fire. Abby's adjusted basis in the building was $145,000 and its FMV was $180,000. Abby filed an insurance claim and she was reimbursed $160,000. In that same year, Abby invested $150,000 of the insurance proceeds in another business building.

a. Assume Abby made the proper election with regard to the involuntary conversion. What is the amount of gain to be recognized by Abby?

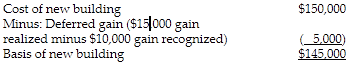

b. What is Abby's basis in the new building?

a.

b.

You might also like to view...

The accounts receivable clerk is responsible for updating the AR Control accounts to reflect each customer sale

Indicate whether the statement is true or false

What is the difference between simple interest and compound interest?

What will be an ideal response?

The ________ is the set of consecutive time periods considered for planning purposes

Fill in the blanks with correct word

A marketer is usually in a better position to establish prices when it knows the prices charged for competing brands.

Answer the following statement true (T) or false (F)