Assume First Central Bank has a desired reserve ratio of 15 percent; $80,000 in total deposits, loans equal to $60,000, and has $20,000 in actual reserves. First Central can make additional loans totaling

A) $8,000.

B) $12,000.

C) $20,000.

D) $60,000.

E) $80,000.

A

You might also like to view...

What condition may provide for a relatively small degree of inefficiency under monopolistic competition?

A) There is a single seller and no product differentiation. B) The marginal cost of production is less than the market price. C) The demand curve is relatively elastic so that the price is near the long-run minimum average cost. D) There is only one buyer in the market.

Suppose that during a given time period the implicit cost for a business was $1,500 and that the explicit cost was $6,000. Also suppose that the firm sold 1,000 units of its products at $7 per item. We can conclude that the firm's

A) accounting profit was $1,000, and its economic profit was -$500. B) accounting and economic profits were both $1000. C) accounting profit was -$500, and economic profit was $1,000. D) accounting profit was $1000, and economic profit was -$1,500.

Larger is always better

Indicate whether the statement is true or false

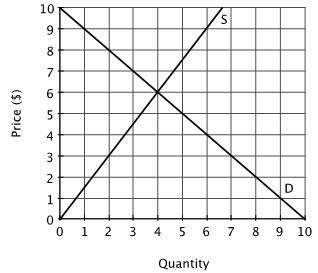

Refer to the accompanying figure. At a price of $9, there will be:

A. an excess demand of 1 unit. B. an excess supply of 5 units. C. an excess demand of 5 units. D. an excess supply of 6 units.