Lola is a 35 percent partner in the LW Partnership. On January 1, LW distributes $39,000 cash to Lola in complete liquidation of her partnership interest. LW has only capital assets and no liabilities at the date of the distribution. Lola's basis in LW is $50,000. What is the amount and character of Lola's gain or loss?

What will be an ideal response?

$11,000 capital loss.

Lola's loss is calculated as the difference between her basis in LW and the cash distribution of $39,000.

You might also like to view...

Describe how the cost of goods sold is calculated when using the periodic inventory system.

What will be an ideal response?

If a company shifts its cost structure by decreasing fixed costs and increasing variable costs, it will lower both the level of risk and its potential for profits.

Answer the following statement true (T) or false (F)

Which sentence is a complex sentence?

A) The committee interviewed four applicants for the position and made its recommendation to the personnel department. B) Many individuals use Facebook to stay connected with friends and family, but some prefer texting or tweeting. C) Although many people reconcile their bank statements online, some individuals still prefer to use hard copies.

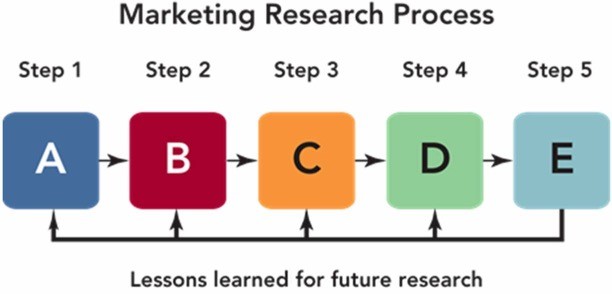

Figure 7-1According to Figure 7-1 above, analyzing the data occurs during which step of the five-step marketing research approach?

Figure 7-1According to Figure 7-1 above, analyzing the data occurs during which step of the five-step marketing research approach?

A. A B. B C. C D. D E. E