The private sector cost of tax revenues is equal to the

a. tax revenue collected by government from individuals in the economy.

b. income that could have been earned by government employees if they had worked in the private sector.

c. difference between government expenditures and tax revenues.

d. tax revenue plus the cost of tax compliance and the excess burden of taxation.

D

You might also like to view...

Negative values of the price elasticity of demand of a good can be attributed to:

A) the Law of Demand. B) the Law of Supply. C) the Law of Increasing Marginal Utility. D) the Law of Diminishing Marginal Rate of Substitution.

A firm can stay in business while taking a loss in the short run as long as it covers its

a. fixed costs. b. variable costs. c. fixed and variable costs. d. A firm can never stay in business when it experiences losses.

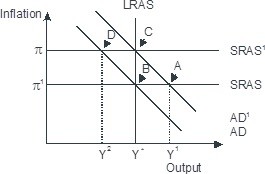

Based on the figure below. Starting from long-run equilibrium at point C, a tax increase that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. D; B C. A; B D. B; C

The wholesale price of cranberries in the market is currently $0.83/lb. The quantity supplied at this price is 90,000 pounds. The quantity demanded is 95,000 pounds. In this case, there is:

a. Excess supply in the market and this is a signal for sellers to decrease price b. Excess supply in the market and this is a signal for suppliers to increase price c. Excess demand in the market and this is a signal for consumers to buy less d. Excess demand in the market and this is a signal for consumers to buy more e. The market is in equilibrium