The partnership has no liabilities on the sale date. Tony's basis in his partnership interest on the date of the sale is $60,000. What is the amount of gain realized by Tony on the sale of his partnership interest?

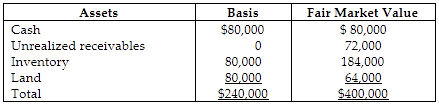

Tony sells his one-fourth interest in the WindyCity Partnership to Bill for $100,000 cash when the partnership's assets are as follows:

Amount realized on sale $100,000

Minus: adjusted basis of partnership interest ( 60,000)

Total gain realized $ 40,000

You might also like to view...

The primary law governing limited partnerships is the ________

A) Revised Uniform Partnership Act (RUPA) B) Uniform Partnership Act (UPA) C) Revised Uniform Limited Partnership Act (RULPA) D) Revised Limited Partnership Act (RLPA)

Bret is convicted of arson for burning down his warehouse to collect the insurance. On an application for insurance from Cover-All Insurance Company on a new building, in answer to a question about prior convictions, Bret does not disclose his conviction. This makes the contract

A. binding because the omission is immaterial to Cover-All's decision to issue coverage. B. binding due to Cover-All's failure to discover Bret's conviction. C. voidable by Bret because the omission is immaterial to Cover-All's decision to issue coverage. D. voidable by Cover-All because the omission is material to its decision to issue coverage.

The average starting salary of this year's MBA students is $35,000 with a standard deviation of $5,000 . Furthermore, it is known that the starting salaries are normally distributed. What are the minimum and the maximum starting salaries of the middle 95% of MBA graduates?

Using your knowledge of GAAP and financial reporting, list and explain one good reason that GAAP should not be used for tax purposes and one good reason that it should be used.

What will be an ideal response?