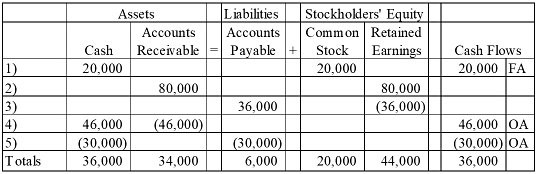

Cascade Corporation began business operations and experienced the following transactions during Year 1:1) Issued common stock for $20,000 cash2) Provided services to customers for $80,000 on account3) Incurred $36,000 of operating expenses on account4) Collected $46,000 cash from customers5) Paid $30,000 on accounts payableRequired:Record the above transactions on a horizontal statements model to reflect their effect on Cascade's financial statements. In the last column, enter OA, IA, or FA for the type of cash flow activity, if applicable.

What will be an ideal response?

You might also like to view...

In the United States, it can be tricky to balance ______ and secular society in the determination of how EML is actually practiced.

a. moral courage b. religious liberty c. universalism d. procedural justice

Statement of Financial Accounting Concepts No. 1 . "Objectives of Financial Reporting by Business Enterprises," identifies investors and creditors as the primary users of financial reporting information. Investors in public companies express their

opinions about an entity's equity securities through organized exchanges such as the New York Stock Exchange. Given that investors represent one of the two primary groups to which financial reporting is directed, accountants and auditors preparing and opining on, respectively, the financial statements of public companies should be aware of the effects of the quality of financial reporting on stock prices. Required: Identify four major periods of decline in worldwide stock prices for the years 1997 through 2002 and discuss the role (if any ) of financial reporting in these declines.

The outbreak of a war between the principal's country and the agent's country may be grounds for terminating an agency

Indicate whether the statement is true or false

Kim Phu and Joey Pantalone form a partnership. Kim and Andy Tortellini form a corporation. Kim dies. Which of the following is TRUE?

A) Only the partnership is dissolved B) Only the corporation is dissolved C) Both the corporation and the partnership are dissolved D) Neither the corporation nor the partnership is dissolved E) Andy and Joey become partners.