Suppose the Fed buys $1 million of government securities from Bank One, a large commercial bank. Bank One's reserves ________ and its deposits ________

A) increase by $1 million; do not change

B) increase by $1 million; increase by $1 million

C) do not change; increase by $1 million

D) do not change; do not change

E) decrease by $1 million; do not change

A

You might also like to view...

The positive effect of having more potential volunteers resulting in a greater likelihood of a beneficial outcome is known as the diffusion effect

Indicate whether the statement is true or false

Real interest rates were negative during most of the

A) 1960s. B) 1970s. C) 1980s. D) 1990s.

If the elasticity of demand for good ALPHA is 2.0,

A. A 10% fall in the price of ALPHA will raise quantity demanded by 2%. B. A price increase will raise total revenue for sellers. C. A 17% increase in the price of ALPHA will lower quantity demanded by 17%. D. A 10% rise in the price of ALPHA will lower quantity demanded by 20%.

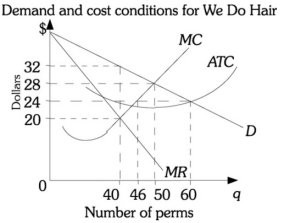

Refer to the information provided in Figure 15.2 below to answer the question(s) that follow.  Figure 15.2 Refer to Figure 15.2. If We Do Hair is maximizing profit as a monopolistically competitive firm, its total revenue equals

Figure 15.2 Refer to Figure 15.2. If We Do Hair is maximizing profit as a monopolistically competitive firm, its total revenue equals

A. $1,280. B. $1,320. C. $1,200. D. $600.