Heron Corporation reported pretax book income of $4,000,000. Included in the computation were favorable temporary differences of $500,000, unfavorable temporary differences of $700,000, and unfavorable permanent differences of $200,000. Compute Heron's current income tax expense or benefit.

What will be an ideal response?

$924,000 current income tax expense.

| Pretax book income | $ | 4,000,000 | |

| Favorable temporary differences | (500,000 | ) | |

| Unfavorable temporary differences | 700,000 | ||

| Unfavorable permanent differences | 200,000 | ||

| Taxable income | $ | 4,400,000 | |

| × 21% | × 21 | % | |

| Current income tax expense | $ | 924,000 | |

You might also like to view...

The ability to earn a satisfactory return on investments is called

a. profitability; b. liquidity; c. leverage; d. expenses; e. turnover

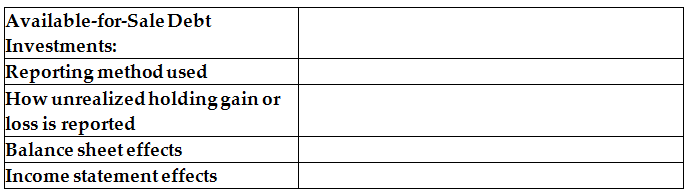

For available-for-sale debt investments, state:

• Reporting method used

• How unrealized holding gain or loss is reported

• Balance sheet effects

• Income statement effects

A direct channel of distribution would most likely be used by:

a. IBM b. McDonald’s c. Home Depot d. Mary Kay Cosmetics e. The Limited

A product has four components A, B, C, and D. The finished product must have a reliability of at least .95. The first three components come from a supplier, and they have reliabilities of .99, .98, and .995, respectively

The fourth component is being designed now. What must the reliability of component D be in order to meet the product reliability condition?