In the country of Kwaki, people produce canoes, fish for salmon, and grow corn. In one year they produced 5000 canoes using labor and natural materials only, but sold only 4000, as the economy entered a recession. The cost of producing each canoe was $1000, but the ones that sold were priced at $1250. They fished $30 million worth of salmon. They used $3 million of the salmon as fertilizer for corn. They grew and ate $55 million of corn. What was Kwaki's GDP for the year?

What will be an ideal response?

Inventories are valued at the cost of production, so the 1000 canoes in inventory were valued at $1000 each, for a total of $1 million. Four thousand canoes at $1250 each totaled $5 million. Salmon as a final good were worth $27 million (the other $3 million were used up as an intermediate good), and corn worth $55 million was grown. So total GDP (in millions) was $1 + $5 + $27 + $55 = $88 million.

You might also like to view...

Rational expectations theory suggests that short-run stabilization policy

A) is best achieved with monetary policy. B) is best achieved with fiscal policy. C) is equally easy to achieve with monetary or fiscal policy. D) should not be attempted.

Refer to the above figure. If an individual firm wants to maximize economic profits, it should

A) charge $5 for its product. B) charge more than $5 for its product since increasing the price will increase revenues. C) charge less than $5 for its product since a lower price will attract more customers. D) withdraw its product from the market forcing the market price up.

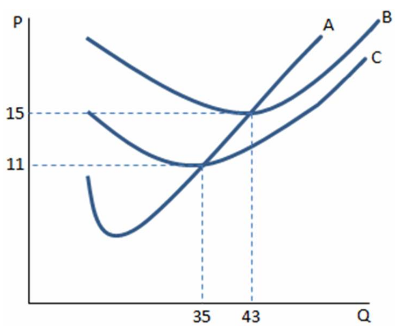

If a firm in a perfectly competitive market faces the cost curves in the graph shown and produces at the profit-maximizing level of output, which of the following is true? A firm will:

A. lose money and shut down in the short run if price falls below $15.

B. lose money, but continue to operate in the short run if price is at least $15.

C. make positive profits any time the price is greater than $15.

D. All of these are true.

Ben quit his job as an economics professor to become a golf professional. He gave up his salary ($40,000 . and invested his retirement fund of $50,000 (which was earning 10 percent interest) in this venture. After all expenses, his net winnings (profit) were $45,000 . Ben's economic profits were

a. $45,000. b. $5,000. c. $2,000. d. zero.