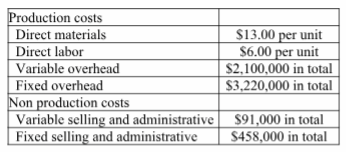

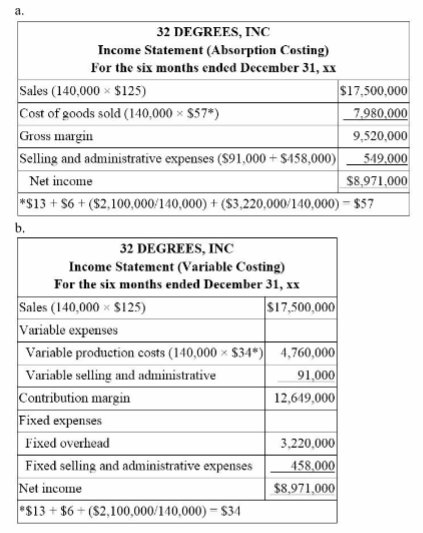

32 Degrees, Inc., a manufacturer of frozen food, began operations on July 1 of the current year. During this time, the company produced 140,000 units and sold 140,000 units at a sales price of $125 per unit. Cost information for this period is shown in the following table:

a. Prepare 32 Degree's December 31st income statement for the current year under absorption costing.

b. Prepare 32 Degree's December 31st income statement for the current year under variable costing.

You might also like to view...

Depreciation methods that provide for a higher depreciation charge in the first year of an asset's life and gradually decreasing charges in subsequent years are called accelerated depreciation methods

a. True b. False Indicate whether the statement is true or false

When gains or losses on derivatives designated as fair value hedges exceed the gains or losses on the item being hedged, the excess

a. affects reported net income. b. is recognized as an equity adjustment. c. is recognized as part of comprehensive income. d. is not recognized.

The 2010 Affordable Care Act requires

A) government assistance to be given when long-term care is needed for those under the age of 65. B) employers, except small businesses, to provide health insurance for employees or pay a fee. C) employers to subsidize child care services for employees if such services are not provided on-site. D) employers to pay for outpatient drug and alcohol counseling for affected employees. E) employers, except small businesses, to provide financial support to retirees.

A small business is often defined as having fewer than ________ employees, as well as being independently owned and operated.

A. 200 B. 100 C. 500 D. 400 E. 300