An optimal corrective tax should be placed on _____

a. the sellers of the externality-generating activity

b. the inputs into the externality-generating activity

c. the externality-generating activity

d. the purchasers of the output of the externality-generating activity

c

You might also like to view...

A black market is

a. a market that operates outside the legal system, either by selling illegal goods or by selling goods at illegal prices. b. a market where goods and services can be obtained at lower prices. c. a government-mandated market where controls are placed on prices. d. a market where exchanges are made using bartering.

A crucial difference between the impact of an import quota compared to a tariff is that:

A. import quotas generate revenue to the domestic government, but tariffs do not. B. import quotas generate no revenue to the domestic government, but tariffs do. C. tariffs increase the prices paid by domestic consumers, but quotas do not. D. both (a) and (c)

Matt is offered a job driving the campus shuttle bus from 4 p.m. to 6 p.m. each Monday. His reservation wage for this job is $7 per hour. Now suppose the director offers Matt $50 per hour, but also announces that the earnings from the job will be divided equally among Matt and the 99 other students who live in Matt's dorm. Will Matt accept this job?

A. Yes, although accepting the job means a negative surplus for Matt, still it's better than having no job. B. Yes, accepting the job means a positive surplus for Matt. C. No, although accepting the job means a positive surplus for Matt, still it's not the best option for him. D. No, accepting the job means a negative surplus for Matt.

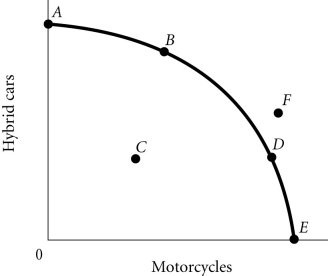

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, Point F

Figure 2.4According to Figure 2.4, Point F

A. is efficient and attainable. B. cannot be produced with the current state of technology. C. represents underallocation of resources. D. represents what the people want.