A market is said to be allocatively efficient when the marginal cost of producing each good equals the marginal benefit that consumers derive from that good

a. True

b. False

A

You might also like to view...

Answer the following statement(s) true (T) or false (F)

1. In the absence of transactions costs, changes in property rights have no effect on economic efficiency. 2. In the absence of transactions costs, changes in property rights have no effect on the distribution of income. 3. Changes in property rights will not affect the allocation of resources as long as transactions costs are zero and the subsequent effects on market demand are negligible. 4. The weak Coase theorem is true when reallocation of property rights have negligible income effects . 5. According to the Coase Theorem, in the absence of transactions costs, recipients of an external benefit can be expected to offer a bribe in exchange for greater production.

There is a negative relationship between the real rate of interest and investment spending

Indicate whether the statement is true or false

If a used car dealer purchases a used car for $3,000, makes repairs and refurbishes it, then sells it for $8,000, the

a. dealer contributes value added equal to $5,000, but nothing is added to GDP. b. dealer contributes value added equal to $5,000, and consequently $5,000 is added to GDP. c. dealer contributes nothing to production because only existing goods are involved. d. dealer contributes value added equal to $8,000, but only $5,000 is added to GDP.

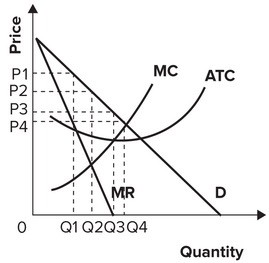

Refer to the graph shown. The profit-maximizing monopolist produces output:

A. Q1. B. Q2. C. Q3. D. Q4.