If the government wants to reduce the burning of fossil fuels, it should impose a tax on

a. buyers of gasoline.

b. sellers of gasoline.

c. either buyers or sellers of gasoline.

d. whichever side of the market is less elastic.

c

You might also like to view...

What results has the Republic of Korea experienced from its change in policies?

What will be an ideal response?

To own a taxicab in New York City, you must own a medallion. New York City regulates the number of official cabs by limiting the number of medallions. Explain why the New York cab industry is not competitive by reviewing the four conditions necessary for competition. NYC violates which one?

What will be an ideal response?

Who tends to benefit from the sugar price supports?

a. users of sugar in other products b. individual users of sugar c. producers of other agricultural products d. producers of sugar e. All of the above are correct.

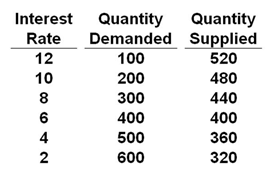

Refer to the below table and information. If changes in tax laws make households save more by $140 billion at each interest rate, then the new equilibrium interest rate would be:

The schedule shows various interest rates, the associated quantity demanded of loanable funds, and the quantity supplied of loanable funds in billions of dollars at those interest rates.

A. 2 percent

B. 4 percent

C. 8 percent

D. 10 percent