The federal funds rate is the interest rate:

a. The Federal Reserve changes banks that borrow from it.

b. U.S. financial institutions charge their best customers.

c. On U.S. interbank loans.

d. Central banks charge individuals.

e. U.S. financial institutions pay to their best (i.e., largest) depositors.

.C

You might also like to view...

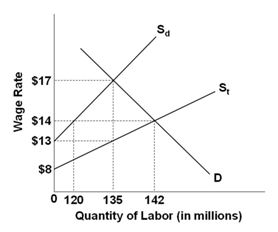

Refer to the below graph of the market for low-skilled labor. Sd is the supply of domestic resident workers, and St is the total supply of labor including undocumented workers. If there are illegal immigrants in the market, how many legal residents will be employed?

A. 15M

B. 120M

C. 135M

D. 22M

Our "dual" banking system refers to

A) commercial banks and thrifts. B) federal and state chartering and supervision of commercial banks. C) stockholder-ownership and depositor-ownership of depository institutions. D) banks that are members and non-members of the Fed.

The difference between the interest a bank earns on loans and securities and the interest paid on deposits and debt divided by the total value of its assets is called

A) interest spread. B) net interest margin. C) return on assets. D) return on equity.

The advertisement approach that allows a consumer to follow up directly to an advertising message is known as

A) direct marketing. B) mass marketing. C) indirect marketing. D) interactive marketing.