Last year, Anthony Millanti earned exactly $30,000 of taxable income. Assume that the income tax system used to determine Anthony's tax liability is progressive

The table below lists the tax brackets and the marginal tax rates that apply to each bracket.

a. Draw a new table that lists the amounts of income tax that Anthony is obligated to pay for each tax bracket, and the total tax he owes the government. (Assume that there are no allowable tax deductions, tax credits, personal exemptions, or any other deductions that Anthony can use to reduce his tax liability).

b. Determine Anthony's average tax rate.

Tax Bracket Marginal Tax Rate

$0-5,000 0.05 (5%)

5,001-10,000 0.10 (10%)

10,001-15,000 0.15 (15%)

15,001-20,000 0.20 (20%)

20,001-25,000 0.25 (25%)

25,001-30,000 0.30 (30%)

a.

Tax Bracket Marginal Tax Rate Tax Liability

$0-5,000 0.05 (5%) $250

5,001-10,000 0.10 (10%) 500

10,001-15,000 0.15 (15%) 750

15,001-20,000 0.20 (20%) 1,000

20,001-25,000 0.25 (25%) 1,250

25,001-30,000 0.30 (30%) 1,500

Total 5,250

b. The average tax rate is equal to the total tax paid divided by total income:

$5,250 / $30,000 = 0.175 (17.5 %)

You might also like to view...

The amount of funds that a nation can withdraw from the International Monetary Fund depends upon

A) the rules set up by the World Bank. B) whether it is seeking a long-term or short-term loan. C) whether it is a developing nation or a developed nation. D) its quota subscription.

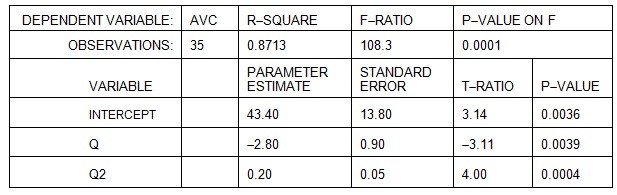

Straker Industries estimated its short-run costs using a U-shaped average variable cost function of the formAVC = a + bQ + cQ2and obtained the following results. Total fixed cost (TFC) at Straker Industries is $1,000.  If Straker Industries produces 20 units of output, what is estimated average variable cost (AVC)?

If Straker Industries produces 20 units of output, what is estimated average variable cost (AVC)?

A. $19.40 B. $67.40 C. $179.40 D. $171.40

If a one percent change in the price of oil causes a -0.02 percent change in the quantity demanded of oil, then -0.02 is the

A. income elasticity of demand. B. price elasticity of supply. C. cross-price elasticity of demand. D. price elasticity of demand.

One of the most controversial features of the Maastricht Treaty is

A) the lack of ability of individual countries to set their own monetary policies. B) increased control of health and safety measures by the European Commission. C) the free movement of labor throughout Europe. D) the elimination of passport controls in parts of Europe.