Which of the following statements about taxation is incorrect?

a. A tax cut affects aggregate demand indirectly.

b. A tax cut raises income and expenditures.

c. Cutting taxes by $20 is not the same as increasing government spending by $20.

d. A change in taxes does not affect consumption.

e. An increase in taxes decreases income and expenditures.

d

You might also like to view...

An example of the "equity vs. simplicity" tradeoff is the tax treatment of

A. capital gains. B. spouses. C. earned income. D. children.

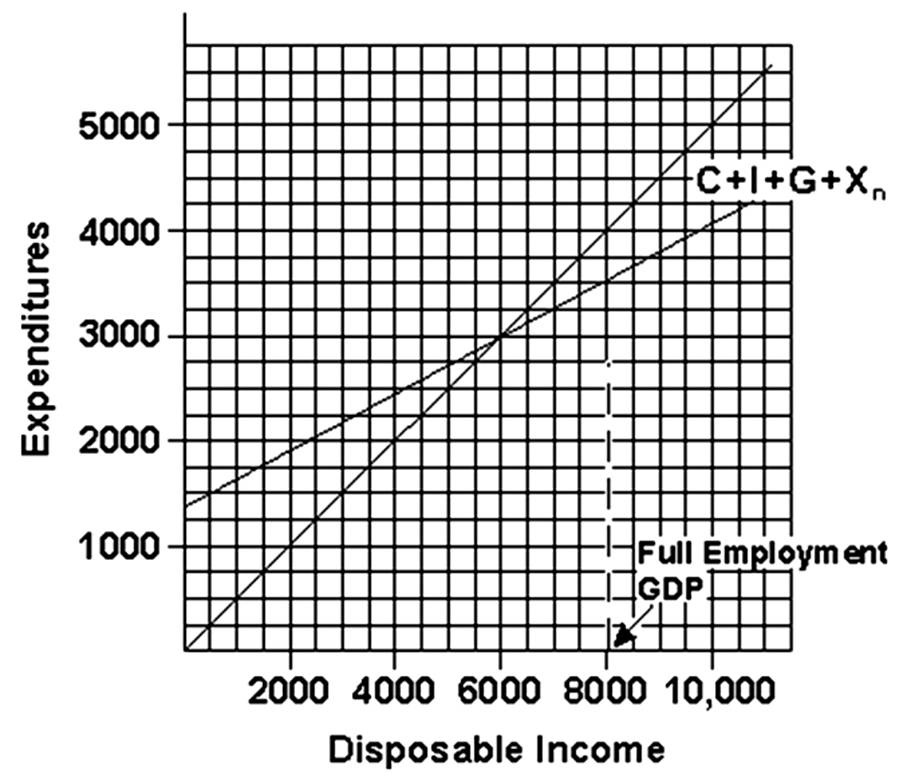

The slope in the above figure is

A) negative and increasing. B) negative and decreasing. C) positive and increasing. D) positive and decreasing.

How much is it?

To reduce the outflow of dollars from the United States, we need to

A. lower the budget deficit and the trade deficit. B. raise the budget deficit and the trade deficit. C. raise the budget deficit and lower the trade deficit. D. lower the budget deficit and raise the trade deficit.