The present value of $500,000 in 4 years at 7 percent interest is approximately:

A. $655,398.

B. $344,682.

C. $381,448.

D. None of these statements is true.

Answer: C

You might also like to view...

If a country is currently lending more to the rest of the world than it is borrowing from the rest of the world, the country is a

A) net borrower. B) debtor nation. C) net lender. D) creditor nation.

Assume that the production of a good imposes external costs upon third parties. If the price and quantity of this good is set by supply and demand the price will be too:

a. high and quantity too low for efficient resource allocation. b. low and quantity too low for efficient resource allocation. c. low and quantity too high for efficient resource allocation. d. high and quantity too high for efficient resource allocation.

If people want more cars than there are cars available, then it is necessarily true that

A) cars are scarce. B) there is a surplus of cars. C) there is a decreased supply of cars. D) none of the above

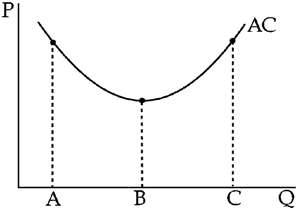

Figure 7-11

Figure 7-11 shows an average cost curve with points on it that correspond to three quantity levels. Which of the following statements must be wrong?

a.

The firm's technology may show increasing marginal returns as production increases from A to B.

b.

The firm may have positive fixed costs.

c.

As production expands from A to B to C, the firm may become increasingly difficult to manage efficiently.

d.

The firm's average fixed cost may rise as production increases from B to C.