The return that a domestic investor receives on a foreign investment is equal to

A) the interest rate on the foreign investment minus the interest rate on a comparable domestic investment.

B) the appreciation rate of the foreign currency minus the appreciation rate of the domestic currency.

C) the interest rate on the foreign investment times the appreciation rate of the foreign currency.

D) the interest rate on the foreign investment minus the rate of appreciation of the domestic currency.

D

You might also like to view...

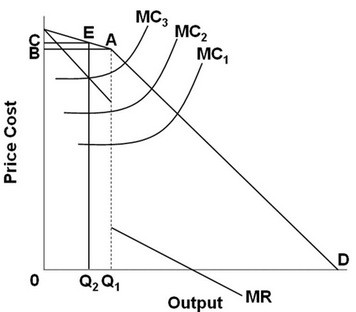

Figure 8-5

A. 10 B. 35 C. 50 D. 60

The U.S. government currently imposes a $0.54 per gallon tariff on all ethanol imported into the country. If this tariff were removed, then:

A) the domestic ethanol price falls. B) the domestic quantity of ethanol supplied declines. C) domestic consumer surplus increases. D) domestic producer surplus decreases. E) all of the above

Based on the graph above, we would expect this firm to sell:

Based on the graph above, we would expect this firm to sell:

A. Q1 units at a price of C. B. Q1 units at a price of B. C. Q2 units at a price of C. D. Q2 units at a price of B.

Spending on programs that Congress authorizes ________ is known as discretionary spending.

A. by prior law B. on an annual basis C. on an off-budget emergency basis D. after approval from the Federal Reserve