If a company employee chooses to follow orders (and breaks the law) the fact that his supervisor ordered him to do so is a complete defense at a criminal trial

a. True

b. False

Indicate whether the statement is true or false

False

You might also like to view...

Blanche works as a respected senior engineer for a large manufacturer of pharmaceutical process equipment. Several researchers within the company have discovered an innovative way to repackage pharmaceutical drugs. The company has given Blanche the opportunity and responsibility to lead a fully funded project team for 12 months to develop this idea. She is excited to lead this ________ team.

A. skunkworks B. venture capital C. spin-off D. social capital E. bootlegging

What is the probability that at least 25 customers arrive at this checkout counter in a given hour?

The IT components of an ERP system architecture include the hardware, software and the:

A) security. B) data. C) organization. D) middleware.

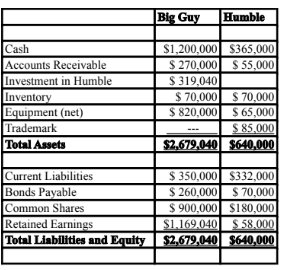

The amount of depreciation expense appearing on Big Guy's June 30, 2020 consolidated income statement would be:

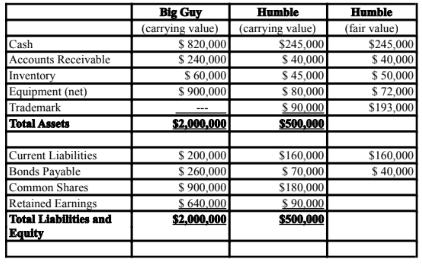

Big Guy Inc. purchased 80% of the outstanding voting shares of Humble Corp. for $360,000 on July 1, 2017. On that date, Humble Corp. had Common Shares and Retained Earnings worth $180,000 and $90,000, respectively. The Equipment had a remaining useful life of 5 years from the date of acquisition. Humble's Bonds mature on July 1, 2027. Both companies use straight line amortization, and no salvage value is assumed

for assets. The trademark is assumed to have an indefinite useful life.

Goodwill is tested annually for impairment. The balance sheets of both companies, as well as Humble's fair market values on the date of acquisition are disclosed below:

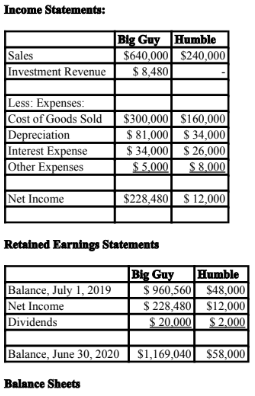

The following are the Financial Statements for both companies for the fiscal year ended June 30, 2020:

An impairment test conducted in September 2018 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded. Both companies use a FIFO system, and Humble's entire inventory on the date of acquisition was sold during the following year. During 2020, Humble Inc. borrowed $20,000 in cash from Big Guy Inc. interest free to finance its operations. Big Guy uses the Equity Method to account for its investment in

Humble Corp. Assume that the entity method applies.

A) $113,400.

B) $115,000.

C) $116,280.

D) $113,720.