Suppose that a government agency is trying to decide between two pollution reduction policy options. Under the permit option, 100 pollution permits would be sold, each allowing emission of one unit of pollution. Firms would be forced to shut down if they produced any units of pollution for which they did not hold a permit. Under the pollution tax option, firms would be taxed $250 for each unit of pollution emitted. The regulated firms all currently pollute and face varying costs of pollution reduction, though all face increasing marginal costs of pollution reduction. Suppose the tax policy is adopted. A firm will be willing to pay the tax if $250 is less than or equal to:

A. the average cost of eliminating one unit of pollution.

B. its average total cost of production.

C. its marginal revenue.

D. the cost of reducing its existing pollution by one unit.

Answer: D

You might also like to view...

A perfectly competitive firm's profit per unit of output equals

a. price minus average variable cost b. price minus marginal cost c. total revenue minus total cost d. price times quantity e. price minus average total cost

When does a firm get a normal return on the use of its resources?

a. at high economic profits in the short run b. at high economic profits in the long run c. at zero economic profits in the short run d. at zero economic profits in the long run

If an inverse relationship exists between two variables, then

What will be an ideal response?

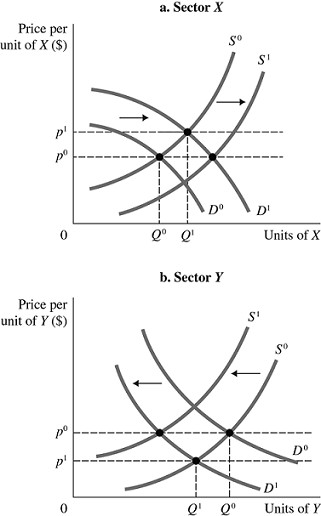

Refer to the information provided in Figure 12.4 below to answer the question(s) that follow. Figure 12.4There are two sectors in the economy, X and Y, and both are in long-run, zero-profit equilibrium at the intersections of S0 and D0.Refer to Figure 12.4. Assume consumer preference changes toward X and away from Y. Ceteris paribus, the likely change in capital flow in sector Y will eventually

Figure 12.4There are two sectors in the economy, X and Y, and both are in long-run, zero-profit equilibrium at the intersections of S0 and D0.Refer to Figure 12.4. Assume consumer preference changes toward X and away from Y. Ceteris paribus, the likely change in capital flow in sector Y will eventually

A. generate excess profits. B. eliminate all profits. C. result in excess losses. D. eliminate all losses.