What is a joint venture? Briefly explain the tax and liability implications of a joint venture.

What will be an ideal response?

A joint venture is a partnership for a limited purpose. It is not a legal entity, so all tax liability is shared among the participants in the venture. Similarly, these participants also share any liability that arises out of the joint venture's activities.?

You might also like to view...

Which of the following is not a category within accumulated other comprehensive income?

a. Post retirement commitments on health plans b. Foreign currency translation adjustments c. Unrealized holding gains and losses on available-for-sale marketable securities d. Changes to stockholders equity resulting from additional minimum pension liability adjustments e. Unrealized gains and losses from derivative instruments

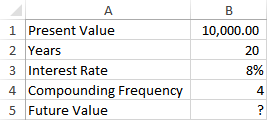

An investment promises a rate of return of 8% per year, compounded quarterly. Which of the following formulas will correctly calculate the future value if you invest $10,000 for 20 years?

a) =FV(B2/B4,B3*B4,0,-B1)

b) =FV(B3/B4,B2/B4,0,-B1)

c) =FV(B3*B4,B2*B4,0,-B1)

d) =FV(B3/B4,B2*B4,0,-B1)

A marketer of exclusive products would be most likely to use ________ marketing

A) mass B) undifferentiated C) differentiated D) niche E) universal

Instrumentality is part of the ______.

a. equity theory b. reinforcement theory c. goal-setting theory d. expectancy theory