If interest rates fall,

A. the demand curve for loans will shift out.

B. the discounted value now of money to be received in the future will fall.

C. some previously unprofitable prospective investments will become profitable.

D. the supply curve for loanable funds will shift in.

Answer: C

You might also like to view...

Are returns to a single input and returns to scale one and the same? Explain.

What will be an ideal response?

Which type of funding is very controversial, and is widely criticized for serving the geopolitical needs of donors instead of assisting poor nations?

a. concessionary loans b. microloans c. multilateral aid d. bilateral foreign aid

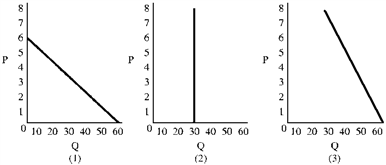

Figure 5-3

Assume the market consists of three consumers with the demand curves in Figure 5-3. At a price of 1, the total market demand is

a.

40.

b.

80.

c.

140.

d.

150.

The potential for asymmetric information to bring about a general decline in product quality in an industry is known as the ________ problem.

A. moral hazard B. capture C. lemons D. liability