If the demand for apples is highly elastic and the supply is highly inelastic, then a tax imposed on apples will be paid:

a. largely by the sellers of apples with more elastic supply.

b. largely by the buyers of apples with more elastic demand.

c. equally by the sellers and buyers of apples

d. largely by the sellers of apples with less elastic supply.

d

You might also like to view...

The most effective redistribution programs provide assistance to the hard core poor and transitory assistance to the marginal poor without _____

a. creating dependency on welfare payments b. costing taxpayers too much c. changing the behavior of individuals d. a and c

Refer to Figure 9.1. Suppose the market is currently in equilibrium. If the government establishes a price ceiling of $20, producer surplus will

A) fall by $200. B) fall by $300. C) remain the same. D) rise by $200. E) rise by $300.

Which of the following correctly defines a budget constraint?

a. A model that economists use for illustrating the choices that individuals face in a situation of scarcity b. A model that shows the level of satisfaction or pleasure that people receive from their choices c. A model that shows the combinations of output that an economy can produce, given a level of technology d. A model that represents the allocation that society most desires

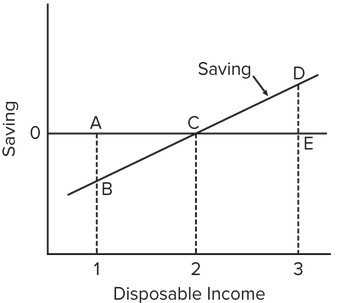

Use the following saving schedule to answer the next question.  Dissaving occurs when disposable income is

Dissaving occurs when disposable income is

A. equal to level 2. B. less than level 2. C. equal to level 3. D. greater than level 2.