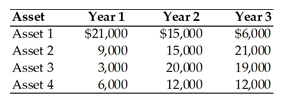

A financial manager must choose between four alternative Assets: 1, 2, 3, and 4. Each asset costs $35,000 and is expected to provide earnings over a three-year period as described below.

Based on the wealth maximization goal, the financial manager would choose ________.

A) Asset 1

B) Asset 2

C) Asset 3

D) Asset 4

A) Asset 1

You might also like to view...

An industrial plant needs to make 100,000 parts per month to meet demand. Each month contains 20 working days, each of which allows for 3 separate 8 hour shifts

(a) If a worker can produce 10 parts/hour, how many workers are needed on each shift? (b) If each shift has 100 workers, what is the productivity of an individual worker? (c) If material costs are $10/part, capital costs are $100,000 and labor costs are $10/hour, what is the multifactor productivity of the plant from part (a)?

To prevent channel conflict, producers or other channel members may do all of the following except

A. provide competing resellers with different brands. B. define policies for direct sales to avoid potential conflict over large accounts. C. combine reseller markets. D. negotiate territorial issues among regional distributors. E. provide recognition to certain resellers for their importance in distributing to others.

Which of the following best defines the tort of interference of with a contract?

A) It occurs when the documents submitted by a party for entering into a contract are found to contain falsified information. B) It occurs when one of the parties involved in a business relationship withdraws from the contract before the end of the contract period. C) It occurs when a business relationship has been formed, and in some way a third party intentionally causes one party to end the relationship. D)It occurs when a government agency helps establish the contractual terms of an agreement between two or more private vendors.

Based on the information shown above, what would it cost to buy 1,000 shares of the above stock?

A) $91,110 B) $91,300 C) $91,320 D) $91,650