The figure below represents the U.S. market for steel imports from Korea. The Korean government provides an export subsidy of $25 per ton, and Korean firms use the subsidy to reduce their export price to the United States to $375 per ton. Suppose the United States now imposes a countervailing duty on its steel imports from Korea to offset the impact of the subsidy provided by the Korean government on its steel exports. The change in U.S. national well-being due to the imposition of this duty is

Suppose the United States now imposes a countervailing duty on its steel imports from Korea to offset the impact of the subsidy provided by the Korean government on its steel exports. The change in U.S. national well-being due to the imposition of this duty is

A. +$3.75 billion.

B. -$4.125 billion.

C. +$3.375 billion.

D. -$375 million.

Answer: D

You might also like to view...

The larger the diameter of a natural gas pipeline is, the lower is the average total cost of transmitting 1,000 cubic feet of gas 1,000 miles. This is an example of one reason for

A. constant returns to scale. B. economies of scale. C. diminishing returns to scale. D. diminishing marginal returns.

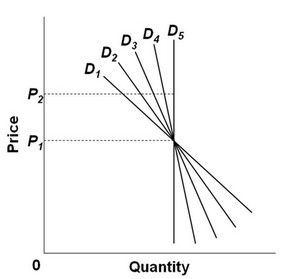

Use the following graph of demand curves to answer the next question.  For a given change in supply, which demand curve is going to yield the largest change in quantity demanded?

For a given change in supply, which demand curve is going to yield the largest change in quantity demanded?

A. D1 B. D3 C. D4 D. D5

If the level of consumption is $100 billion and disposable income is $125 billion, then the

A) APC = 0.6 and saving is positive. B) APC = 0.8 and saving is negative. C) APC = 0.8 and saving is positive. D) APC = 0.6 and saving is negative.

If the labor market is perfectly competitive the wage rate will be less than the marginal revenue product of labor

a. True b. False Indicate whether the statement is true or false