Why is the supply of loanable funds often relatively inelastic with respect to interest rates?

What will be an ideal response?

The supply is often interest inelastic because some savers have fixed accumulation goals, i.e., they have a particular target sum in mind. If the interest rate increases, they can reach their goal with less saving. Therefore, an increase in interest rates will not bring forth more saving (lending) from those persons.

You might also like to view...

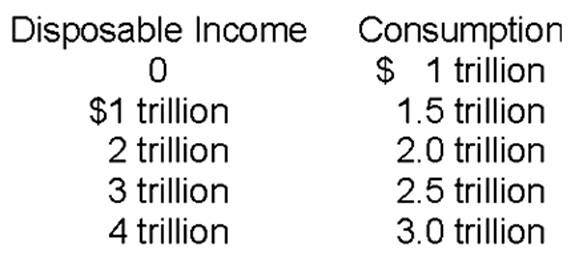

How much is the average propensity to consume when disposable income is $2 trillion?

A. .25

B. .5

C. .75

D. 1.0

The rising portion of a perfectly competitive firm's marginal cost curve, above the intersection with AVC, is its

A) demand curve. B) economic profit. C) supply curve. D) accounting profit.

In the textbook model of endogenous growth, long-run output growth would increase if there were either a ________ in the saving rate or a ________ in the depreciation rate.

A. rise; fall B. rise; rise C. fall; fall D. fall; rise

Refer to the information provided in Table 3.1 below to answer the question(s) that follow. Table 3.1Price per PizzaQuantity Demanded (Pizzas per Month)Quantity Supplied (Pizzas per Month)$31,200 600 61,000 700 9 800 80012 600 90015 4001,000Refer to Table 3.1. If the price per pizza is $3, the price will

A. decrease because there is an excess supply in the market. B. remain constant because the market is in equilibrium. C. increase because there is an excess demand in the market. D. increase because there is an excess supply in the market.