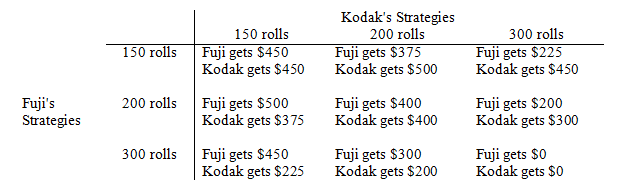

Fuji and Kodak produce identical film. The market demand for film is given by P = 8 - Q, where P is the price (in dollars per roll of film) and Q is the quantity (in hundreds of rolls). Each firm has the option of producing 150, 200, or 300 rolls of film at a constant marginal cost of $2 per roll with no fixed costs. The firms' possible profits for various outcomes are summarized in the accompanying table.

(i) If the two firms behave competitively, what will be the outcome of this game? Is this outcome Pareto optimal for the firms?

(ii) If the two firms merge and form a monopoly, what will be the outcome of this game? Is this outcome Pareto optimal for the firms?

(iii) What is the Nash equilibrium for this game? Is it Pareto optimal for the firms? How does it compare with the competitive and monopoly outcomes?

(iv) Suppose this game is played sequentially, with Fuji as the first player. What will be the Stackelberg equilibrium? Is it Pareto optimal?

(i) Solve the equation P = MC to show that 600 rolls of film are produced in competition. Thus the lower right-hand corner is the competitive equilibrium. This outcome is not Pareto optimal for the firms, since a movement to the northwest is a Pareto improvement. (The competitive outcome is, of course, Pareto optimal for society overall.)

(ii) When the demand curve is linear, the marginal revenue curve has the same vertical intercept and double the slope, so marginal revenue is given by MR = 8 - 2Q. Solve the equation MR = MC to show that 300 rolls of film are produced when the industry is monopolized. Thus the upper left-hand corner is the monopoly equilibrium. This outcome is Pareto optimal for the firms (but not, of course, for society overall).

(iii) The center outcome is the Nash equilibrium. When one firm produces 200 rolls of film, it is optimal for the other firm to also produce 200 rolls of film. This outcome is not Pareto optimal for the firms, because the upper left-hand corner would be a Pareto improvement. The Nash equilibrium lies between the competitive and monopoly equilibria.

(iv) Fuji's payoff is $375 if it produces 150 rolls (since Kodak will produce 200 rolls), $400 if it produces 200 rolls (since Kodak will also produce 200 rolls), and $450 if it produces 300 rolls (since Kodak will produce 150 rolls). The latter payoff is the best, so the Stackelberg equilibrium is the lower left-hand corner. This outcome is not Pareto optimal, since both firms would get higher profits if Fuji reduced its production.

You might also like to view...

How much is a bond that pays $80 in coupon payments for 4 years and $1,000 at the end of the fourth year worth if the interest rate is 6%?

A) $855.46 B) $1,045.56 C) $1,069.30 D) $1,140.00

Fluctuating interest rates tend to stabilize real output when the

A) IS curve is flat. B) IS curve is steep. C) LM curve is flat. D) LM curve is steep.

Firms want to capture consumer surplus

Indicate whether the statement is true or false

All cash within the geographical boundaries of the United States is counted as part of the U.S. money supply

a. True b. False