Forge Company, a calendar-year entity, had 6,000 units in its beginning inventory for 20X8. On December 31, 20X7, applying the lower-of-cost-or-market (NRV) principle, the units had been adjusted down to $470 per unit from an actual cost of $510 per unit. It was the lower of cost or market (NRV). No additional units were purchased during 20X8. The following additional information is provided for 20X8: Inventory Unit Market QuarterDate (units) Value FirstMarch 31, 20X8 4,800 $455 SecondJune 30, 20X8 4,000 480 ThirdSeptember 30, 20X8 3,100 440 FourthDecember 31, 20X8 2,000 455 Forge does not have sufficient experience with the seasonal market for its inventory units and assumes that any reductions in market value during the year will be

permanent.Based on the preceding information, the cost of goods sold for the first quarter is:

A. $546,000

B. $564,000

C. $636,000

D. $624,000

Answer: C

Business

You might also like to view...

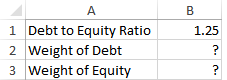

What are the correct formulas for cells B2 and B3?

a) =B1/(1-B1) and =1/(1-B1)

b) =B1/(1+B1) and =1/(1+B1)

c) =B1/(1+B1)^2 and =1/(1+B1)^2

d) =B1/(1-B1)^2 and =1/(1-B1)^2

e) =B1/(B1-1) and =1/(B1-1)

Business

Explain the "Front Page" test

What will be an ideal response?

Business

The par value of stock is an arbitrary per share amount defined in many states as legal capital

Indicate whether the statement is true or false

Business

You should include your final—but not your first—opaque slide for your annotated presentation

a. true b. false

Business