The Fed increases the money supply by buying securities for $300 million. The impact of this increase, in the long-run, would be to

A. raise the average price level and increase the level of real GDP.

B. raise the average price level, but real GDP (output) would stay the same.

C. raise the real supply of loanable funds, lower the interest rate, and increase the demand for output.

D. raise the real supply and demand for loanable funds with an increase in the interest rate.

C. raise the real supply of loanable funds, lower the interest rate, and increase the demand for output.

You might also like to view...

To calculate GDP when using the income approach, you must add indirect business taxes and depreciation

Indicate whether the statement is true or false

The European Central Bank has its headquarter in

A) London. B) Berlin. C) Frankfurt. D) Paris. E) Brussels.

The liquidity premium theory holds that investors

A) always choose the bond with the highest expected return, regardless of maturity. B) require a term premium to compensate them for investing in a less preferred maturity. C) view bonds of different maturities as perfect substitutes. D) view bonds of different maturities as completely unsubstitutable.

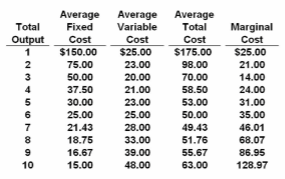

Refer to the data. If the market price for this firm's product is $35, it will produce:

A. 6 units at a loss of $150.

B. 6 units at a loss of $90.

C. 9 units at an economic profit of $281.97.

D. 8 units at an economic profit of $130.72.