Myrna's personal residence (adjusted basis of $100,000) was condemned, and she received a condemnation award of $80,000 . Myrna used the condemnation proceeds to purchase a new residence for $90,000 . What is her recognized gain or loss and her basis in the new residence?

a. $0; $70,000.

b. $0; $90,000.

c. ($20,000); $90,000.

d. ($20,000); $70,000.

e. None of the above.

b

You might also like to view...

Chose the correct number form in parentheses. She finished only (2/3, two-thirds) of her essay test before the end of class

The Boston Consulting Group (BCG) matrix, _____ are companies that have a small share of a fast-growing market.

a. cash cows b. dogs c. stars d. question marks

Answer the following statement(s) true (T) or false (F)

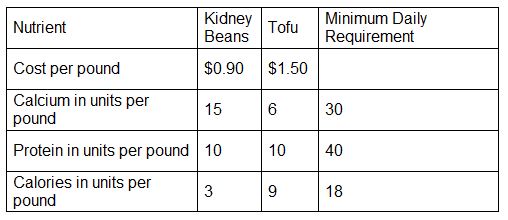

1. At the optimum solution, the number of calories contributed by tofu is equal to that provided by kidney beans.

A school is trying to determine a nutritional diet to feed its students. The school would like to offer some combination of milk and beans. The school’s objective is to minimize cost, subject to meeting the minimum nutritional requirements of protein, calcium, and calories. The cost and nutritional content of each food, along with the minimum nutritional requirements are shown here.

A random sample of 87 airline pilots recruited by an airline service had an average yearly income of $99,400 with a standard deviation of $12,000. a.If we want to determine a 95% confidence interval for the average yearly income of the population, what is the value of t?b.Develop a 95% confidence interval for the average yearly income of all pilots.

What will be an ideal response?