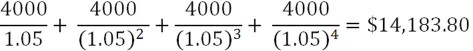

A computer you are considering for your business would add $4,000 per year to your profit. It would cost $400 a year to buy a complete maintenance contract so that you would never have repair and upkeep expense. The obsolescence depreciation is 25% a year. The going market interest rate is 5%. Assume all costs and revenue occur at the end of the year. What is the present value of the income stream from the machine?

What will be an ideal response?

You might also like to view...

Is each of the following situations an example of savings, investment, or neither? In each case explain your choice

(a) A savings and loan association lends money for the purchase of "junk" (not backed) bonds. (b) John's income is $25,000 per year; $22,000 is spent on consumer goods and the remaining money is used purchase stock in the local electric company. (c) Just before retirement a couple sells their shares of Pacific Bell stock and puts the proceeds in a bank savings account. (d) The city of Los Angeles rebuilds highways after an earthquake. (e) In order to improve the income earning potential of current welfare recipients, the federal government increases the size of income transfers.

"Under floating rates, the economy is more vulnerable to shocks coming from the domestic money market." Discuss

What will be an ideal response?

Which one of the following assets has the greater liquidity?

a. A $10 pizza b. A $10 ticket to next week's basketball game c. A $100 stereo d. A dollar bill e. A $200 U.S. savings bond

A decrease in the number of producers will shift supply to the left

a. True b. False Indicate whether the statement is true or false